In 2026, Miami’s institutional real estate market has completed its structural shift from a hub of post‑pandemic speculation to a permanent target for General Partner‑led real estate fund strategies. For sophisticated General Partners (GPs), the challenge is no longer finding opportunities—it is demonstrating the operational sophistication necessary to attract family offices and institutional Limited Partners (LPs) who now demand transparency, governance, and downside protection without precedent.

This playbook sits alongside ARCSA CAPITAL’s 2026 Institutional Real Estate Investment Strategy in Miami and dedicated guides for family offices and wealth managers, forming a complete framework for institutional-grade capital deployment. The focus is clear: in Miami’s current market environment, beta is a commodity; alpha must be manufactured through short-cycle execution, regulatory arbitrage, and disciplined underwriting—not hoped for through cap rate compression.

For a full market‑level view of Miami’s 2026 risk anchors, capital flows, and demographic fundamentals, see the Institutional Real Estate Investment Strategy in Miami | 2026 Guide.

SUMARY

CONTENT

Why Miami Still Attracts Institutional Capital in 2026

Market safety anchors and liquidity

Miami has been ranked the #2 target for commercial real estate investment in the U.S. by the CBRE Investor Intentions Survey, cementing its position as a core plus allocation for institutional portfolios. Its primary safety anchor is a powerful combination of defensive resilience and offensive opportunity.

The market’s liquidity floor is formidable: 66% of all international transactions in South Florida are executed in all-cash, reducing dependence on bank financing and insulating valuations from interest rate volatility. Foreign buyers represent 52% of all new construction sales, underpinning price stability even in periods of tighter credit.

Simultaneously, this environment creates tactical opportunities for well-capitalized GPs. The 2,502 foreclosure filings in Q3 2025 represent a historically low 0.8% of total transactions—not systemic weakness, but a selective pipeline of quality assets falling from over-leveraged players. For agile operators with access to institutional capital, this is a prime hunting ground for acquiring assets at a discounted basis without fundamental execution risk.

General Partners that want to situate their fund‑level playbook inside a broader Sun Belt and regulatory context can refer to the Institutional Real Estate Investment Strategy in Miami | 2026 Guide for market, legal, and tax frameworks.

Demand drivers and rental fundamentals

Miami’s transformation into «Wall Street South» is now a permanent structural reality, not a cyclical narrative. The migration of firms including Citadel, Blackstone, and Thoma Bravo has generated a stable capital ecosystem that sustains demand for professionally managed Class A and prime residential assets.

Rental fundamentals remain strong due to structural inventory scarcity and persistent inflows of high-income talent attracted by Florida’s tax environment. For GPs, this durable, inelastic demand provides the fundamental bedrock for successful value-add strategies—it is the raw material needed to manufacture performance and build a compelling thesis for institutional LPs actively targeting this market.

What Institutional Capital Expects from a GP LP in 2026

Track record, governance, and reporting

In 2026, execution capacity is no longer assumed—it is audited. LPs are conducting due diligence not only on the deal, but on the GP’s entire operational infrastructure. Success is now defined by institutional-grade governance, radical transparency, and a compliance framework that functions as a competitive advantage.

Radical transparency (ILPA 2026): The new Institutional Limited Partners Association (ILPA) reporting templates, effective Q1 2026, are the mandated industry standard. They require granular disclosure of all fees and expenses, and critically, the impact of subscription lines on net IRR. Proactive adoption generates immediate trust and significantly accelerates the LP due diligence process.arcsa-capital-institutional.

Institutional-grade compliance (FinCEN): The new Financial Crimes Enforcement Network (FinCEN) Anti-Money Laundering (AML Compliance) rules, effective January 2026, transform compliance into a strategic asset. For GPs targeting international capital—especially from Latin America and Europe—a robust AML/KYC program provides a «safe harbor,» mitigating the risk of transactional blockages or the unwinding of non-compliant investments.

Technology-enabled governance: Over 40% of LPs now require their GPs to demonstrate the use of technology and AI for operational efficiency and reporting, aligning with the fact that 51% of private equity firms are hiring data scientists and AI experts to industrialize value creation.

What to do:

- Implement real-time reporting systems and corporate governance that includes frequent external audits.

- Adopt ILPA-compliant templates before LP requests them.

- Build a robust AML/KYC process as part of your infrastructure, not as a reactive compliance exercise.

What to avoid:

- Presenting financial statements without normalization or lacking a clear risk-management framework.

- Opaque technology stacks or manual reporting processes that cannot scale.

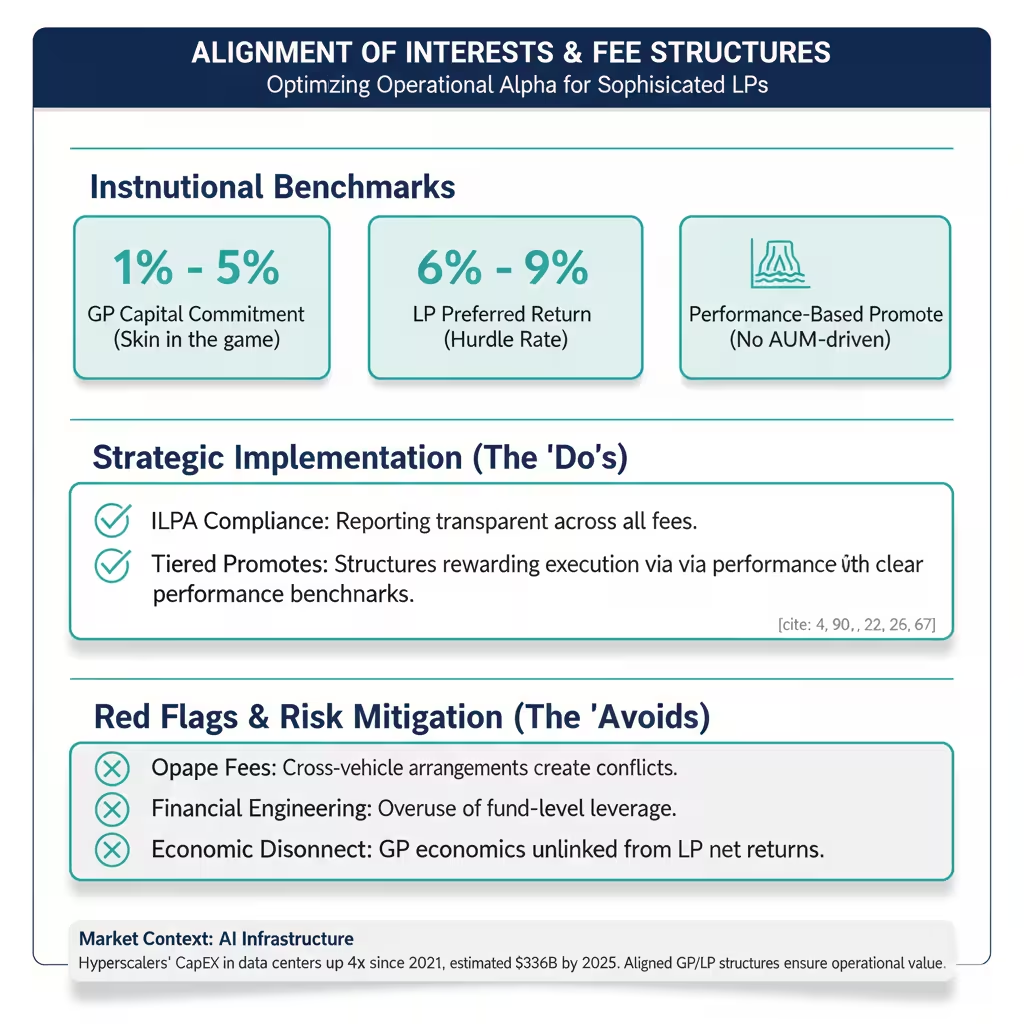

Alignment of interests and fee structures (GP/LP, Co GP)

Sophisticated LPs are laser-focused on ensuring GPs are rewarded for manufacturing true operational alpha, not for financial engineering or riding market beta. The structure of the deal must demonstrate unimpeachable alignment of interests.

Institutional-grade alignment benchmarks:

- GP capital commitment: Industry standard ranges from 1–5% of total fund capital, demonstrating meaningful «skin in the game.»

- LP preferred return: Typical structures provide a 6–9% preferred return to LPs before the GP participates in promote or carry.

- Promote structure: Waterfalls should heavily reward outperformance on net IRR after the LP preferred return is met, not AUM-based fees.

What to do:

- Structure deals with clear, ILPA-compliant reporting on all fees.

- Design promote structures that reward execution, with catch-up provisions and tiered promotes that align with performance hurdles.

What to avoid:

- Opaque fee structures or cross-vehicle fee arrangements that create conflicts of interest.

- Overuse of fund-level leverage to inflate IRR figures without corresponding operational value creation.

- Structures where GP economics are disconnected from LP net returns.

Institutional-Grade Underwriting and Deal Selection in Miami

Underwriting discipline and stress testing

In Miami’s 2026 «high-altitude» market environment, institutional LPs are not investing in a market—they are investing in a GP’s ability to industrialize value creation. Underwriting must be defensively designed, conservative, and relentlessly stress-tested.

Presenting your pipeline to an institutional LP:

- Demonstrate data-driven forecasting: Show how AI and data analytics are used for more precise underwriting, moving beyond historical comps to predictive modeling.

- Articulate downside scenarios clearly: Stress-test assumptions against interest rate increases of at least 100–200 basis points and elevated vacancy scenarios.

- Link value creation to operational improvements: Present a clear thesis for how value will be created operationally, recognizing that 70% of value creation now comes from operational improvements, not market beta.

- Avoid «hope-based» underwriting: Do not base exit projections on cap rate compression without a radical operational improvement justification.

Common red flags for institutional LPs:

- Relying on cap rate compression or market growth instead of a clear plan for operational value creation.

- Inability to provide granular, ILPA-compliant reporting.

- Weak or non-existent AML/KYC compliance framework, creating risk for international LPs under new FinCEN rules.

Strategic Pillars of Institutional Alpha in Miami 2026

| Strategic Pillar | Key Operational Alpha / Technology | Regulatory Advantage (Regulatory Alpha) | Investment Thesis & Asset Classes | Compliance & Governance Standards | Market Dynamics (Miami 2026) | Source |

| Regulatory Arbitrage (Live Local Act) | Administrative approvals (by-right) bypassing political zoning processes; reducing entitlement risk from years to months. | Florida’s Live Local Act (SB 102/1730); preemption of local zoning; maximum density and height allowed by right. | Value-Add Residential; converting underutilized commercial/industrial land into high-density residential at lower cost bases. | Use of ‘missing middle’ property tax exemptions (75–100%) to directly increase Net Operating Income (NOI). | Transformation of ‘Wall Street South’; 66% of international transactions are cash-only, creating a resilient ‘liquidity floor’. | [1] |

| Operational Alpha & AI Integration | AI-driven EBITDA growth; automation of financial value chains, precision forecasting, and predictive maintenance to defend NOI. | Regulatory Alpha as a defensive moat; navigating complex legal frameworks to unlock value where others see restrictions. | Transition from financial engineering to fundamental business improvement; PE firms hiring data scientists to modernize operations. | New ILPA 2026 reporting standards; granular transparency on fees, expenses, and leverage; ‘human-in-the-loop’ governance for AI. | Miami as the #2 US commercial real estate target; ‘high-altitude’ investing with valuations near historical highs but high macro volatility. | [1] |

| Institutional-Grade Compliance & AML Compliance | Infrastructure for institutional-grade compliance as a competitive advantage for capturing international capital (LATAM/Europe). | FinCEN AML/KYC rules (effective Jan 1, 2026) for investment advisors; mitigation of ‘unwinding’ risks in non-compliant structures. | Preferred access for Family Offices seeking safe haven in USD; focus on transparent, audited GP/LP structures in jurisdictions like Delaware. | Mandatory written AML programs, designated compliance officers, and independent audits; strict identification of beneficial owners. | Retailization of private capital through Evergreen structures; 20% of private markets expected in semi-liquid vehicles. | [1] |

| Federal Tax & Liquidity Optimization | Strategic use of the ‘One Big Beautiful Bill Act’ (OBBBA) for interest deductibility (Section 163(j)) based on EBITDA. | Qualified Small Business Stock (QSBS) Section 1202 expansion for massive capital gains tax exemptions on portfolio exits. | Capitalizing on ‘compelled sellers’ and secondary markets; continuation funds projected to represent 20% of distributions. | Radical transparency in reporting metrics to accelerate due diligence and meet LP demands for DPI (Distributed to Paid-In Capital). | A ‘K-shaped’ recovery where tech and critical infrastructure outperform; demand for real assets as an inflation hedge. |

Short cycle value-add execution (90–180 days)

In the 2026 capital environment, LPs are demanding strategies that resolve the multi-year «distribution drought» by offering faster liquidity and return of capital (DPI). Short-cycle value-add execution is the direct strategic response.

This approach focuses on acquiring assets from «compelled sellers»—sellers who need to generate liquidity due to fund-level dynamics (e.g., meeting LP redemption requests, nearing fund expiration, covenant breaches) rather than any fundamental problem with the asset itself. The GP can then manufacture returns through disciplined execution over a 90–180 day period, stabilizing NOI and crystallizing value without relying on market appreciation.

Typical compelled seller scenarios:

- Fund managers facing LP redemption pressure.

- Operators breaching debt covenants due to floating-rate exposure.

- Closed-end funds nearing expiration without extension options.

The ability to identify the right asset, negotiate the right entry basis, and structure the right institutional partnership is paramount to this strategy.

Structuring Institutional Relationships and Capital Stacks

Co GP, JV, and club deal structures

Co GP, Joint Venture (JV), and club deal structures are the primary vehicles for experienced GPs to partner with family offices and institutional LPs. These arrangements allow a GP to target larger, higher-quality assets than they could acquire alone, pooling capital and expertise under a clearly defined partnership agreement.

Key structural considerations:

- Control vs. economics: Co-GP structures typically provide shared decision-making on major actions (capital calls, refinancing, disposition), while JVs may grant the operating GP more day-to-day discretion.

- Alignment on exit timing: Clear governance provisions (drag-along, tag-along rights) must be defined upfront to avoid conflicts at exit.

“Many institutional investors are reallocating from traditional closed‑end vehicles into evergreen fund structures and continuation funds, seeking greater flexibility on exit timing and a reduction in the typical multi‑year ‘distribution drought’.”

Risk-sharing, promotes, and waterfalls

In institutional real estate structures, the preferred return is the minimum annual return that LPs are entitled to receive before the General Partner participates in the promote or carried interest. Most institutional LPs expect a clearly defined preferred return, typically in the mid‑single to high‑single digits, that must be paid before the GP shares in the upside economics.

A well-structured waterfall is the core mechanism that aligns interests in an institutional partnership. The structure typically follows this sequence:

- Return of LP capital: All LP invested capital is returned first.

- LP preferred return: LP receives a preferred return (typically 6–9%) on invested capital.

- GP catch-up: GP may receive a catch-up to a specified profit split (e.g., 80/20 or 70/30).

- Promote tiers: Additional promotes are earned at performance hurdles, rewarding outperformance.

What to seek:

- Structures that reward over-execution via tiered promotes and catch-up provisions.

- LP protection clauses, including GP removal provisions for cause (material breach, fraud, persistent underperformance).

What to avoid:

- Waterfall structures that are opaque or include cross-subsidization between different investment vehicles.

- Fee structures that generate economics for the GP regardless of LP net returns.

General Partner Real Estate Fund Economics – Market Benchmarks 2026

| Strategy type | Typical LP preferred return (range) | GP equity commitment (range % del equity) | Target hold period | Typical promote split | Primary LP profile | Source |

| Core+ | 6% – 8% | 1% – 5% | 7 – 10 years | 15% – 20% over hurdle | Sovereign wealth, large institutional, pension funds | [Inferred] |

| Value‑Add | 8% – 10% | 2% – 7% | 3 – 5 years | 20% tiered; 20% – 30% second tier | Institutional, family offices, endowments | [Inferred] |

| Short‑Cycle Value‑Add | 10% – 12% | 5% – 10% | 18 – 36 months | 20% catch-up; 25% – 30% carry | Family offices, HNW wealth investors | [Inferred] |

Execution Discipline: From Term Sheet to Exit

Construction / asset management standards

Closing the deal is merely the beginning. Real alpha is created—or destroyed—during the holding period through disciplined asset management. The mandate for GPs in 2026 is to generate «Operational Alpha» by treating real estate as an active business requiring technology-driven industrialization.

Technology-enabled management:

- AI-powered management: Using AI to optimize energy consumption, predict maintenance needs, and proactively protect and grow Net Operating Income (NOI).

- Unified data platforms: Implementing integrated portfolio management systems rather than fragmented, one-off tech solutions to ensure scalable operations and avoid «pilot fatigue.»

- Turning labor into software: Focusing on technology-driven workflows to reduce manual work and lower structural SG&A costs.

Miami-specific execution risks:

- Cost volatility in construction materials and labor.

- Insurance cost escalation and HOA volatility.

- Regulatory changes affecting permitting timelines.

Best practice: Use technology for real-time construction monitoring and integrated property management systems that maximize EBITDA through operational efficiency.

Exit planning and downside protection

For an institutional-grade GP, exit planning begins during underwriting, not at stabilization. This foresight involves identifying the future buyer pool and building an asset that meets institutional acquisition criteria from day one.

Exit strategy considerations:

- Buyer pool identification: Core+ institutional buyers, 1031 exchange investors, or portfolio roll-ups.

- Refinancing vs. disposition: Clear triggers for recapitalization vs. full exit based on market conditions and LP liquidity needs.

- Regulatory alpha monetization: Positioning assets that benefit from zoning changes (e.g., Live Local Act densification) to command premium exit multiples.

Downside protection mini-checklist:

- Drag-along and tag-along rights clearly defined in partnership agreements.

- Adequate liquidity reserves maintained to cover operational contingencies.

- Stress-tested refinancing plans that do not rely on cap rate compression.

Critical mistake to avoid: Ignoring regulatory alpha opportunities like the Live Local Act. This indicates a lack of sophisticated local expertise and an inability to manufacture value. The core arbitrage allows a GP to acquire underutilized commercial land at a «warehouse» cost basis and develop it with «residential tower» metrics, capturing a massive value spread through administrative right, not political risk.

Co Investment Structures with Family Offices and Institutional LPs

Co‑investment allows select family offices and institutional LPs to invest directly alongside the General Partner in specific Miami real estate fund deals, rather than only through a blind‑pool vehicle. This structure typically offers improved economics for the co‑investor fewer fees, more direct promote participation in exchange for higher concentration and deeper due diligence while preserving the GP’s operational control and alignment of interests.

How ARCSA CAPITAL Partners with GPs in Miami

Ideal GP profile and deal types

ARCSA CAPITAL is built to be the institutional platform for high-quality General Partners in Miami, providing the capital, strategic oversight, and infrastructure needed to execute and scale in the 2026 market.

Our ideal partner profile:

- An experienced operator with a proven track record in residential real estate.

- A specialist focused on value-add strategies in prime Miami submarkets (e.g., Coral Gables, Coconut Grove, Kendall).

- A partner who can execute on «Regulatory Alpha,» specifically by leveraging the Live Local Act to transform an asset’s highest and best use and unlock value.

- A team committed to institutional standards of transparency, reporting, and compliance (ILPA, FinCEN, technology-enabled governance).

Preferred deal types:

- Multifamily value-add with short-cycle execution (90–180 days to NOI stabilization).

- Mixed-use and residential assets that benefit from densification or regulatory tailwinds.

- Compelled-seller acquisitions with clear operational value-creation thesis.

FAQs: General Partners & Institutional Capital in Miami 2026

1. What are institutional LPs really looking for in a GP in 2026?

They want three things: a verifiable track record, institutional governance (ILPA-style reporting, audits, investment committee), and a clear thesis for how you manufacture operational alpha in Miami, not just market beta.

2. What is a reasonable “skin in the game” range for a GP?

In many institutional structures, a reference range is for the GP to commit roughly 1–5% of total vehicle or deal equity, calibrated to the GP’s balance sheet.

3. What preferred return do institutional LPs typically expect?

It is common to see LP preferred returns in the approximate 6–9% annual range before the GP starts participating in the promote, always subject to deal-by-deal negotiation.

4. How should a GP stress-test a deal in Miami 2026?

At minimum, by modeling scenarios with +100–200 basis points in interest rates, stressed vacancy, and sensitivity of NOI to increases in insurance, operating expenses, and refinancing costs.

5. Why is a 90–180 day short cycle value-add strategy so relevant now?

Because many LPs are emerging from a “distribution drought” and prioritize strategies that return capital (DPI) quickly through execution, instead of depending on cap rate compression over 5–7 years.

6. What is the difference between a “compelled seller” and an opportunistic seller?

A compelled seller must generate liquidity due to structural pressures (redemptions, fund life, covenants) even if the asset is sound; an opportunistic seller trades mainly on price or portfolio rotation with less urgency.

7. What do LPs now require on reporting and compliance?

Up-to-date ILPA templates, granular fee and expense breakdowns, visibility on subscription lines, and a robust AML/KYC program aligned with FinCEN rules for international investors.

8. What is the real role of technology and AI for an institutional GP?

To move from manual reporting to integrated platforms, use data and models for more precise underwriting, and apply AI to predictive maintenance, energy efficiency, and execution monitoring.

9. What does “Regulatory Alpha” mean in the Miami context?

It is the ability to capture value through legal and zoning frameworks such as the Live Local Act, allowing a change in highest-and-best use (for example, from underutilized commercial to higher-density residential).

10. How does ARCSA CAPITAL work with GPs that fit this profile?

ARCSA evaluates thesis and track record, co-underwrites a live deal using institutional models, structures a Co-GP/JV relationship with a clear waterfall, and then provides capital, governance, and platform support to scale in Miami.

Process to evaluate and onboard new GPs

ARCSA CAPITAL follows a disciplined and transparent process to evaluate and onboard new GP partners, ensuring alignment from the outset.

Phase 1: Initial thesis & track record review

- Deep dive into the GP’s investment thesis, strategy, and historical performance.

- Verification of operational infrastructure, compliance frameworks, and reporting capabilities.

Phase 2: Deal-level underwriting & stress testing

- Collaboration to underwrite a live deal, pressure-testing all assumptions against ARCSA’s institutional models.

- Validation of market data, comp analysis, and execution timeline.

Phase 3: Partnership structuring & documentation

- Jointly structuring a partnership agreement (Co-GP, JV, or club deal) that aligns interests and establishes clear governance.

- Agreement on waterfall structure, preferred returns, GP commitment, and exit governance.

Phase 4: Onboarding & execution

- Onboarded partners gain access to the full ARCSA CAPITAL platform to support execution, reporting, and institutional compliance.

- Ongoing partnership monitoring, quarterly performance reviews, and strategic refinement.

Family offices, wealth managers, and institutional LPs evaluating GP platforms in Miami can use this article together with ARCSA’s master Institutional Real Estate Investment Strategy in Miami | 2026 Guide as an integrated decision toolkit for 2026 allocations.

Conclusion: Manufacturing Alpha in Miami’s 2026 Market

For ARCSA CAPITAL and its General Partner real estate fund partners, the thesis is clear: we do not bet on the market rising—we manufacture returns through active management and rigorous operational discipline.

Document prepared by ARCSA CAPITAL | Institutional Real Estate Investment Platform | Miami 2026