Capital Allocation Strategies | ARCSA’s Institutional Approach in Florida

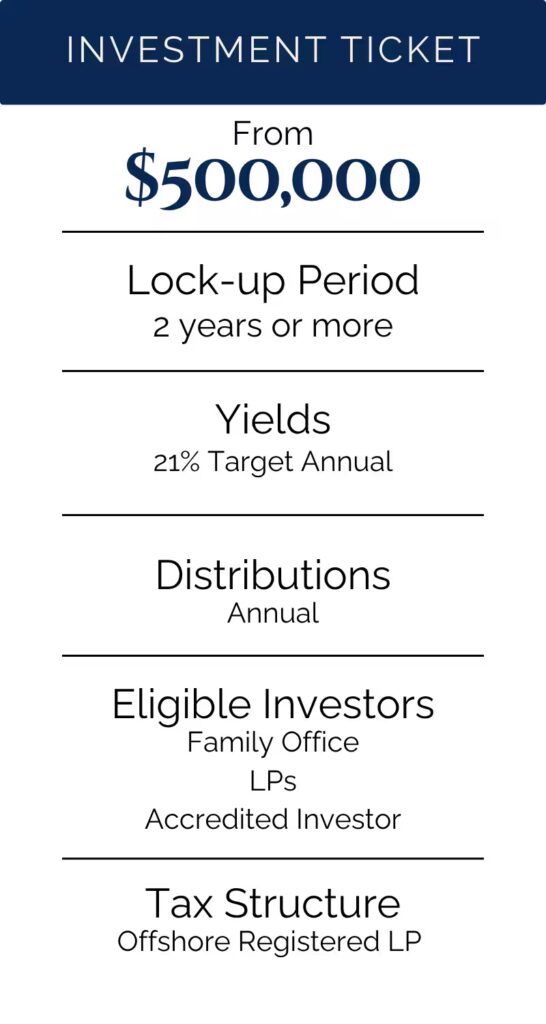

Yields are higher than the banking sector.

You do not need a visa to invest.

Protected investment in dollars against inflation.

We are a group of expert investors and managers.

You do not need to have a bank account in the USA.

We invest your money in the best property assets.

What do we invest in?

Our portfolio is designed by experts and real estate investment managers, thinking about the geopolitical and economic changes that are constantly changing.

WhatDoWeInvestInP2x U.S.: Florida.

Capital allocation isn't just a financial exercise — it's a strategic art. at arcsa capital, we approach it with a rigorous institutional mindset, especially when operating in one of the most dynamic markets in the united states: florida.

We explore the key principles that guide our strategy, why Florida is central to our deployment plans, and how we build resilient portfolios designed for long-term stability and growth.

Why Capital Allocation Matters for Institutional Investors

“For a complete framework on how to deploy capital in Florida, explore: Institutional Real Estate Investment Strategy Guide for Miami 2026.”

Why Capital Allocation Matters for Institutional Investors

For institutional investors, how and where capital is allocated determines not only return profiles but risk exposure, liquidity, and compliance.

Unlike retail strategies that might chase trends, we focus on methodical deployment that prioritizes capital protection, asset quality, and governance.

For institutional investors, how and where capital is allocated determines not only return profiles but risk exposure, liquidity, and compliance. Unlike retail strategies that might chase trends, we focus on methodical deployment that prioritizes capital protection, asset quality, and governance.

Capital allocation drives performance across:

- Asset diversification

- Portfolio resilience in volatile markets

- Alignment with regulatory and fiduciary obligations

When done right, it becomes a cornerstone of institutional excellence.

Core Principles of ARCSA’s Capital Deployment Strategy

We don’t believe in speculative positioning. Our strategies are engineered to be transparent, analytical, and repeatable.

Risk Assessment and Capital Protection

We start by identifying environments where capital can be preserved first, and grown second. Florida's real estate cycles require careful underwriting and macro awareness. In our experience, this means passing on flashy but volatile opportunities.

Asset Prioritization: Commercial, Multifamily, and Land

We deploy capital across three main asset classes:

- Commercial real estate with long-term tenant stability

- Multifamily properties in high-growth corridors

- Strategic land positions near expanding metro areas

Each asset is vetted for its yield potential, legal encumbrances, and demographic relevance.

Ensuring Governance and Regulatory Compliance

Our institutional DNA means strict adherence to:

- SEC and IRS guidelines

- Transparent investor reporting

- Third-party audits

This isn’t just about legal boxes; it builds long-term trust and accountability.

Florida: A Strategic Market for Capital Allocation

Tax Benefits and Business Climate

Florida remains one of the few states with no state income tax, making it highly attractive for both investors and residents. Additionally, its business-friendly policies accelerate growth across sectors.

Demographic Trends Fueling Real Estate Demand

We’ve seen consistent in-migration to Florida, particularly among high-income households and retirees. This fuels steady demand in:

- Housing

- Logistics infrastructure

- Health and senior care facilities

Focus Regions: Miami, Tampa, Orlando

Our capital is concentrated in metros with:

- Diverse economies

- Infrastructure investment

- Workforce population growth

These aren’t speculative plays. They’re grounded in data and fundamentals.

Building Resilient Portfolios Through Diversification

Navigating Economic Cycles

We actively adjust allocation weights depending on macro cycles. For instance, during rate hike environments, we emphasize income stability over growth potential.

Balancing Stability and Returns

Our goal is not to maximize returns at all costs. It’s to optimize for risk-adjusted performance. That often means choosing assets with slightly lower yields but stronger downside protection.

Institutional vs Retail Allocation Strategies

Retail investors often react to market sentiment. In contrast, we rely on:

- Long-term economic indicators

- Quantitative stress testing

- Conservative debt ratios

That’s what allows us to endure and capitalize when markets reset.

Real Estate Returns Strategy

At ARCSA, our real estate strategy is not about chasing the highest yield—it's about identifying the most durable one. We focus on building portfolios with predictable income, long-term appreciation potential, and resilience against market downturns. Explore our strategy in depth →

Institutional Real Estate Protection

La protección del capital va más allá de la simple prevención de riesgos : es un proceso proactivo de debida diligencia, inteligencia de mercado y suscripción disciplinada. Nuestro enfoque protege el capital institucional de la volatilidad, a la vez que lo posiciona para obtener beneficios. Descubra cómo protegemos el capital →

FAQs: Capital Allocation Best Practices

What is the biggest mistake in capital allocation?

Chasing short-term trends without assessing downside risk or liquidity needs.

Why is Florida ideal for institutional capital?

Favorable taxes, population growth, and infrastructure investment create a stable deployment environment.

How do you balance return and safety?

Through diversification, governance, and prioritizing assets with long-term demand fundamentals.

Is governance really that important?

Absolutely. Without it, scale is unmanageable and investor trust erodes.

What are the key benefits of institutional capital allocation strategies in the Florida real estate market?

Institutional capital allocation ensures capital protection, portfolio diversification, and access to high-quality assets. In Florida, these strategies leverage favorable tax laws, population growth, and robust infrastructure—creating stable returns and minimizing market volatility.

How do accredited investors mitigate risks when investing in commercial properties in Florida?

Accredited investors mitigate risk by employing strict due diligence, selecting assets with long-term leases, and working with experienced fund managers. They also prioritize market data analysis and regulatory compliance to safeguard their capital in Florida’s dynamic market.

Why is portfolio diversification essential for long-term real estate investment success in Florida?

Diversifying your real estate portfolio in Florida helps reduce exposure to individual property risks and market cycles. It also enables investors to capitalize on growth across various asset classes, from multifamily units to commercial developments, enhancing long-term performance.

What due diligence steps should investors take before allocating capital to Florida real estate funds?

Investors should research the fund’s track record, review independent audits, analyze market trends, and confirm regulatory compliance. Detailed asset evaluations and performance projections are also advised to make informed capital allocation decisions in Florida.

How does ARCSA ensure transparency and governance for international investors in Florida?

ARCSA maintains transparency through detailed reporting, regular audits, and adherence to SEC and IRS regulations. International investors benefit from robust governance protocols, ensuring that capital is managed securely and professionally.

Why Institutional Investors Trust ARCSA Capital

La confianza no se construye de la noche a la mañana. Se gana con el rendimiento, la transparencia y la constancia. Nuestros socios valoran la estructura, la gobernanza y la responsabilidad que aportamos a cada decisión de inversión. Descubra nuestra filosofía centrada en el inversor →