1.0 Executive Summary

This report on the New York Rent Freeze serves as an essential briefing for institutional investors, lenders, and family offices evaluating the real estate landscape in New York City. The proposal for a stringent, multi-year freeze, championed by political figures responding to a perceived housing crisis, represents a critical inflection point. It not only threatens the financial viability of nearly one million rent-stabilized units but also accelerates a broader, strategic reallocation of institutional capital away from markets with high and unpredictable regulatory risk toward those offering stability, fiscal advantages, and pro-development policies.

This analysis quantifies the primary financial risks, synthesizes the documented effects of similar policies in international markets, and outlines a data-driven framework for capital reallocation.

An institutional real estate investment strategy in Miami

This inflection point reinforces the need for a disciplined institutional real estate investment strategy, capable of reallocating capital away from high-regulatory-risk jurisdictions toward markets with stronger fundamentals.Sumary

For institutional investors, REITs, banks, and family offices, these findings underscore a fundamental shift in the risk/return profile of New York real estate. The erosion of predictable returns, driven by escalating regulatory hostility, stands in sharp contrast to the opportunities emerging in pro-development markets across the Sun Belt. The strategic imperative is clear: capital must migrate from jurisdictions where political intervention de-links asset value from economic fundamentals to those where policy fosters stability, growth, and the successful execution of proven investment models.

2.0 New York Rent Freeze Context: Catalyst for a Rent Control Proposal

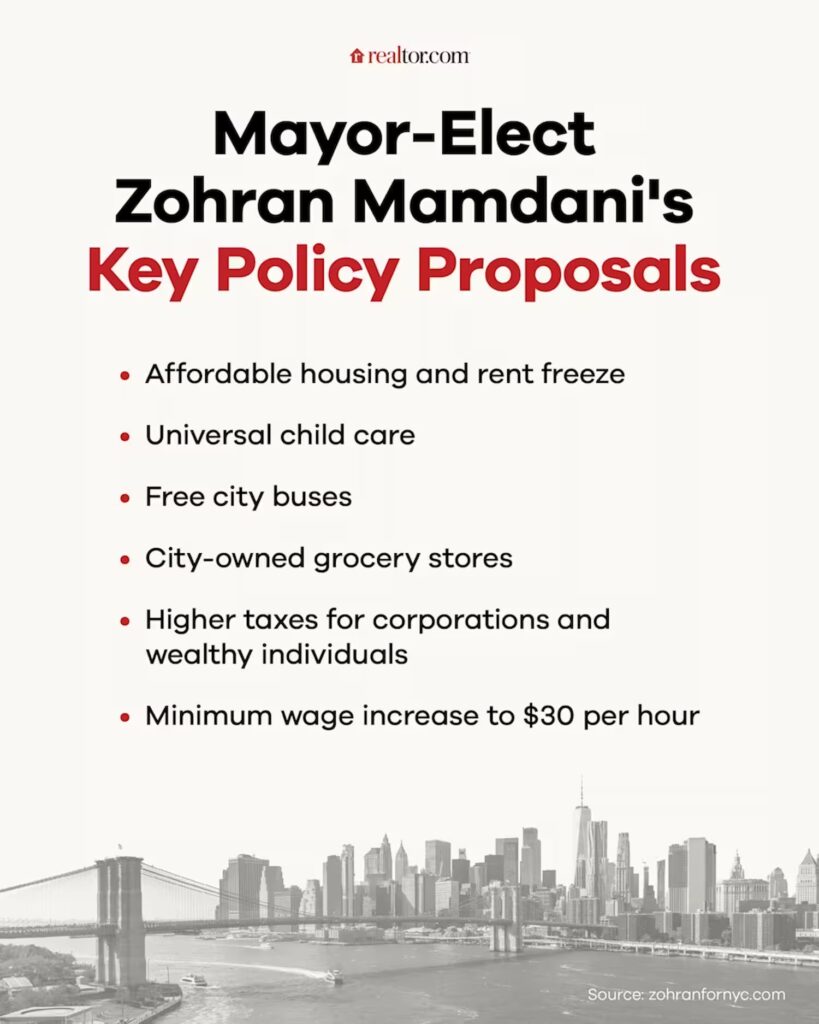

The proposal for a multi-year rent freeze in New York City did not emerge in a vacuum. It is a direct and politically potent response to a long-simmering housing affordability crisis, championed by ascendant political figures like Assemblyman Zohran Mamdani. Understanding this political and social context is crucial for institutional investors seeking to accurately assess the proposal’s market risk and its potential for becoming policy. The proposal is not merely an economic debate; it is a political statement that has already had tangible financial consequences.

The political figurehead for the rent freeze is Zohran Mamdani, whose platform is built on protecting tenants from displacement. His stated goal is to shield residents in rent-stabilized units, who have a median income of approximately $60,000, from any rent increases that could force them from their homes. This position frames the debate as one of social equity versus landlord profits, a narrative that resonates strongly within the city’s political climate.

These shifts also mirror behavioral changes observed among global LPs and family offices documented in our Institutional Investors Trust analysis.The immediate financial market reaction to this platform was sharp and unambiguous, a phenomenon dubbed the “effect Zohran.” Following the proposal’s amplification, the stock prices of New York-exposed Real Estate Investment Trusts (REITs), including major players like SL Green Realty and Vornado Realty Trust, experienced a notable decline. This market movement serves as a clear and quantifiable indicator of how institutional capital perceives the increased regulatory risk. It signals a belief that the political momentum behind such policies is credible and poses a direct threat to future cash flows and asset valuations.

Such unpredictable policy environments highlight why our capital allocation strategy prioritizes jurisdictions that protect investor governance and operational continuity.This political backdrop thus sets the stage for a deeper analysis of the proposed policy’s mechanics and its place within New York’s complex legal framework for rent regulation.

3.0 Defining the Intervention: Rent Freeze, Rent Control, and Regulatory Authority

For investors and lenders, precise terminology in regulatory analysis is fundamental to modeling risk and projecting cash flows. The distinction between a «rent freeze,» «rent control,» and «rent stabilization» is not merely semantic; it defines the severity of the intervention and its impact on a property’s Net Operating Income (NOI). Understanding these differences and the institutional bodies that wield regulatory power is the first step in assessing the financial threat.

Rent Freeze This is a rigid, «first-generation» form of price control. It is characterized by fixed or severely restricted prices, effectively setting NOI growth to zero and eliminating nearly all mechanisms for owners to adjust revenue in response to rising operating expenses.

New York rent control apartments & Rent Stabilization These are broader terms for policies that regulate the rate of rent increases. In New York City, rent stabilization is the dominant form of regulation, covering nearly one million apartments. While it restricts the percentage by which rents can be raised annually, it has historically allowed for adjustments based on operating costs and capital improvements, albeit with increasing limitations. A rent freeze would represent a radical hardening of the existing stabilization framework.

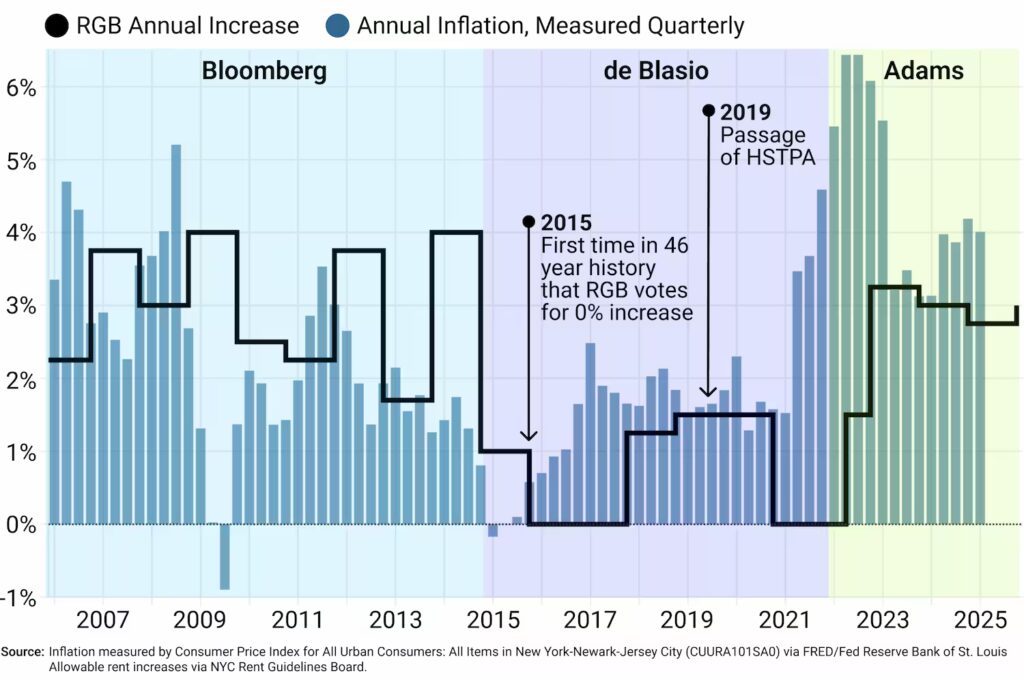

The primary institutional body responsible for setting annual rent adjustments for stabilized apartments is the Rent Guidelines Board (RGB). The Mayor of New York holds the key lever of power over this process through their authority to appoint the board’s members. A mayor sympathetic to a rent freeze, such as Zohran Mamdani, could therefore appoint board members committed to implementing a 0% rent increase, effectively enacting a freeze through existing regulatory channels.

For institutional markets, these legal and procedural nuances are interpreted as significant risk signals. The politicization of the RGB and the potential for drastic policy shifts based on electoral outcomes directly increase the perceived «Regulatory Beta» of New York real estate assets. This heightened risk premium reflects the profound uncertainty surrounding the future of revenue streams, which are no longer tied purely to market dynamics but are instead vulnerable to political intervention.

4.0 The Economic Consensus on Price Controls in Housing

To build a robust investment thesis, it is essential to ground it in established economic theory and empirical evidence. A vast body of academic research spanning decades has studied the effects of rent control, providing a powerful framework for anticipating the consequences of New York’s proposed freeze. The overwhelming consensus among economists is that rent control, as a form of price ceiling, is an inefficient and often counterproductive policy for addressing housing affordability.

Historical precedents consistently show that price controls distort fundamentals—another reason investor discipline must be grounded in a rigorous capital protection framework.The fundamental theory holds that imposing a price ceiling below the market-clearing price inevitably reduces the quantity and quality of the regulated good—in this case, housing. This is not a controversial position; a meta-analysis reviewing 112 empirical studies on the topic confirms that the theoretical consensus on the negative effects of rent control is overwhelmingly corroborated by real-world data. The primary market distortions are predictable and well-documented.

- Supply and Construction Disincentives: Price controls directly deter investment in new rental housing construction. Simultaneously, they create a powerful incentive for owners of existing properties to withdraw their units from the rental market, often through conversion to condominiums or other non-regulated uses. This reduction in supply exacerbates the very housing shortage the policy purports to solve.

- Deterioration in Quality and Maintenance: Rent controls sever the link between revenue and property condition. By capping or freezing income, the policy eliminates the economic incentive for landlords to invest in capital expenditures (CAPEX) for upkeep and improvements. This leads to a phenomenon known as «deferred maintenance,» where the physical quality of the housing stock systematically deteriorates over time.

- Housing Misallocation and Reduced Mobility: Rent control creates a market inefficiency known as misallocation. Tenants in controlled units, benefiting from artificially low rents, are 10% to 20% more likely to remain in their apartments even if their housing needs change (e.g., a family grows, or children move out). This reduces residential mobility and locks up available housing stock, making it harder for new residents to find suitable homes.

This robust theoretical framework, validated by extensive empirical research, provides a clear forecast of the market distortions a rent freeze would impose on New York City. The next section examines specific case studies where these theories have been proven in practice.

5.0 International Evidence: A Comparative Analysis of Rent Control Outcomes

The theoretical impacts of rent control have been empirically validated in numerous international markets, providing a data-driven forecast for the potential consequences in New York City. By evaluating the documented outcomes in key cities that have implemented stringent price controls, investors can move beyond theory to understand the real-world effects on investment, supply, quality, and maintenance.

Berlin (Mietendeckel)

Berlin’s 2020 rent freeze, known as the Mietendeckel, serves as a stark modern cautionary tale. The policy led to a «marked reduction» in housing supply as owners withdrew units from the market. Quantitatively, the number of advertised rental units fell by more than half while the law was in effect. Furthermore, the freeze had a chilling effect on investment in the quality of the housing stock; a survey of private landlords revealed that nearly 60% reduced their willingness to make large investments in their properties.

Buenos Aires (2020–2023 Law and its Repeal)

The case of Buenos Aires offers a powerful natural experiment, demonstrating the market’s high elasticity of supply to regulation. A restrictive 2020 rental law caused rental availability to drop by 45%. However, in direct response to the law’s repeal in late 2023, the market response was immediate and dramatic. Rental availability surged by 170%, and this flood of new supply led to a corresponding 40% drop in real rental prices. Causal analysis of the immediate aftermath confirms this trend, showing that the deregulation directly prompted a 42% to 88% surge in rental listings. This outcome highlights how quickly capital and housing units will exit a hostile regulatory environment and how rapidly they will return once market-based principles are restored.

San Francisco

A quasi-experimental study by the National Bureau of Economic Research (NBER) on the expansion of rent control in San Francisco provides further compelling evidence. The research found that the policy led to a 15% reduction in the city’s rental housing stock as landlords converted their properties to evade regulation. This supply reduction had a predictable «spillover effect» on the broader market, causing a 5.1% increase in city-wide rents. The study also quantified the mechanism of this supply reduction, finding that buildings subject to the new regulations were 10% more likely to be converted to condominiums.

While other cities such as Stockholm, Montreal, and Vienna are often cited in discussions of rent control, the provided source material does not contain specific empirical data to facilitate a detailed analysis of their outcomes.

In summary, the empirical evidence from these diverse international markets reveals a consistent pattern: stringent rent controls predictably lead to a reduction in the supply of rental housing, a decline in investment and maintenance, and, paradoxically, an increase in rents in the unregulated segment of the market.

Rental Market Impact Report 2025

BERLIN

Rent Freeze PolicyBUENOS AIRES

DeregulationSAN FRANCISCO

Expansion Zoning

6.0 The Impact on Institutional Investment

Regulatory changes like the proposed New York rent freeze have direct, quantifiable, and often severe consequences for the business models and risk profiles of institutional investors. The impact cascades across the capital stack, from senior lenders to equity holders, fundamentally altering the viability of real estate as an asset class in the affected jurisdiction.

6.1 Banks and Credit Markets

Credit Risk

The impact on credit risk for lenders with exposure to New York’s regulated multifamily market is acute. The delinquency rate for loans collateralized by these assets is projected to reach a peak of 16.43% in 2025. This figure is catastrophic when contrasted with the delinquency rate of less than 1% for non-regulated properties, signaling a concentrated and systemic risk to the regional banking sector.

These credit distortions alter underwriting standards and risk-adjusted returns, directly informing our predictable 21% annual yield methodology for pro-development markets.Collateral and Underwriting

The post-HSTPA asset devaluation of approximately 30% has severely eroded the value of loan collateral. A rent freeze would accelerate this decline, forcing banks to provision more capital against expected losses and dramatically tighten underwriting standards for new loans. This has already attracted regulatory scrutiny, with the SEC examining the exposure of regional banks like Dime Community Bancshares and Flagstar Financial. The collapse of Signature Bank, which held $11 billion in loans tied to these buildings, serves as a stark precedent.

The institutional general partner playbook for real estate funds

Access to Credit

The increasingly hostile regulatory environment has led to a significant contraction in financing availability. With deteriorating collateral values and paralyzed cash flows, lenders are unable to underwrite new loans, and existing owners find it nearly impossible to refinance. This credit crunch freezes transaction markets and prevents even routine capital improvements, guaranteeing further deterioration of the housing stock.

How financial advisors are reallocating real estate exposure

6.2 Real Estate Investment Trusts (REITs)

Stock Market Impact

Publicly traded REITs are immediately vulnerable to shifts in investor sentiment regarding regulatory risk. The «effect Zohran»—the documented drop in the share prices of New York-exposed REITs like Vornado Realty Trust and SL Green Realty following the amplification of the rent freeze proposal—is a clear measure of this sensitivity. The market is pricing in the high probability of diminished future earnings.

REITs exposed to freeze-prone jurisdictions see persistent pricing penalties, reinforcing the advantage of the more selective, value-engineered approach described in our investment strategy framework.Impact on Cash Flow

A rent freeze creates a devastating scenario for REITs’ cash flow. It imposes zero growth on Net Operating Income (NOI) while operating expenses (Opex)—such as taxes, insurance, and utilities—continue to rise with inflation. This structural compression of margins directly erodes Funds From Operations (FFO), the primary metric of REIT profitability and the source of shareholder dividends.

Pressure for Portfolio Changes

Faced with a politically imposed ceiling on revenue growth, REITs are compelled to re-evaluate their portfolio strategies. This pressure forces them to divest from high-regulation zones like New York and reallocate capital to markets that offer predictable cash flow growth and a more stable regulatory environment.

6.3 Premium Real Estate Investment Funds

Impact on Core Investment Metrics

For private equity and premium investment funds, a rent freeze fundamentally breaks established valuation models. Core metrics like the Internal Rate of Return (IRR) are predicated on NOI growth. When NOI is frozen, traditional Discounted Cash Flow (DCF) models become invalid, and future value is destroyed. Cap rates expand to account for the heightened risk, further depressing asset values (Value = NOI / Cap Rate).

Inviability of Value-Add Investment Cycles

The popular and historically profitable Value-Add investment strategy is rendered entirely inviable by New York’s regulatory regime. The model’s success depends on acquiring, improving, and repositioning an asset to increase its NOI. The HSTPA’s severe restrictions on recovering the cost of Major Capital Improvements (MCIs) and Individual Apartment Improvements (IAIs) already crippled this model; a rent freeze would be its death knell.

Market Substitution

As a direct consequence, funds are actively engaging in market substitution. This involves exiting the New York market and redeploying capital into pro-development jurisdictions where Value-Add and other growth-oriented strategies can be executed without the threat of political expropriation of returns.

6.4 Family Offices

Threat to Long-Term Wealth Preservation

Family offices, which often have multi-generational investment horizons, prioritize stability and predictable appreciation. The extreme regulatory risk in New York directly undermines these long-term wealth preservation strategies by introducing a level of political uncertainty that makes it impossible to forecast returns over decades.

Capital Migration to the Sunbelt

There is a documented trend of family office capital migrating from traditional markets like New York to high-growth cities in the Sunbelt. This strategic reallocation is not driven by short-term speculation but by a fundamental reassessment of where long-term capital can be safely and profitably stewarded.

Effect on Generational Wealth

For legacy holders of New York real estate, the hostile regulatory environment represents a direct threat to generational wealth. Decades of appreciation can be erased by policies that de-link property values from underlying economic fundamentals, effectively trapping capital in a deteriorating asset class.

The consistent theme across all investor classes is a flight to safety and predictability, a trend that highlights not just the problems in regulated markets but also the corresponding opportunities presented by pro-development alternatives.

7.0 Strategic Opportunity: Prime Residential Value-Add (PRVA) in Pro-Development Markets

The Prime Residential Value-Add (PRVA) model is a high-return strategy central to institutional real estate investment. It involves acquiring multifamily properties (typically Class B or C), executing strategic capital improvements to modernize units and common areas, and thereby increasing the property’s Net Operating Income (NOI) to capture significant appreciation. The success of this model is fundamentally tied to a favorable and predictable regulatory environment that allows for the recovery of capital investment through rent adjustments.

The PRVA model is fundamentally incompatible with the regulatory environment in New York City. The strategy’s core mechanism—investing capital to drive NOI growth—is directly and intentionally undermined by rent control. The 2019 Housing Stability & Tenant Protection Act (HSTPA) already crippled this model by severely restricting an owner’s ability to recover the costs of improvements (MCIs/IAIs). A rent freeze would represent the final blow, making it impossible to generate any return on capital invested in property upgrades, thus ensuring the long-term deterioration of the housing stock.

In stark contrast, the PRVA model executes with high profitability and scalability in markets with a different set of characteristics. These pro-development jurisdictions share several key attributes:

- A pro-development culture with few and flexible zoning restrictions.

- Legislation that is either pro-landlord or balanced, ensuring legal and financial certainty.

- The absence of a political ceiling on rent growth, allowing revenues to track market demand.

- Strong underlying demographic and economic fundamentals, including population and job growth.

Miami, Florida, stands out as a leading national market for the PRVA strategy. Its powerful combination of zero state income tax, pro-landlord laws, robust population growth, and strong global demand creates an ideal ecosystem for this investment model. In markets like Miami, investors can confidently underwrite capital improvement plans, knowing that the regulatory framework supports—rather than penalizes—the enhancement of housing quality and value.

This clear distinction in regulatory environments is driving a strategic shift in capital allocation, as investors pivot from markets where proven strategies are prohibited to those where they can thrive.

This asymmetry is precisely why our capital allocation model prioritizes markets like Miami, Tampa, and pro-development Sun Belt metros.

8.0 Alternative U.S. Cities for Institutional Capital Reallocation

Due to the escalating and unpredictable regulatory risk in New York, institutional capital is undergoing a strategic migration toward markets that offer stability, growth, and policy predictability. This section provides a data-driven ranking of the top alternative U.S. markets that have become primary destinations for this capital flight, evaluated based on their superior risk/return profile for real estate investment.

Top 10 U.S. Markets for Institutional Real Estate Investment (2025 Ranking)

| Rank | City (State) | Primary Investment Model(s) | Key Rationale for Investment |

| 1 | Miami, Florida | Prime Residential Value-Add | Ranked #1 for its 0% state income tax, global demand, pro-landlord legislation, and minimal regulatory risk, enabling superior net returns. |

| 2 | Dallas–Fort Worth, Texas | Multifamily Core-Plus, Industrial Logistics | Characterized by extremely high population absorption, friendly regulation, and stable investment models in multifamily and industrial sectors. |

| 3 | Austin, Texas | Tech Relocation, Multifamily Class A | A booming tech hub with strong demand from a young professional demographic, few zoning restrictions, and no political controls on rent growth. |

| 4 | Phoenix, Arizona | Build-to-Rent (BTR), Suburban Value-Add, Senior Living | Offers ideal conditions for scalability due to land availability and rapid construction, with rents growing without a «political ceiling.» |

| 5 | Tampa, Florida | Multifamily Core-Plus, Repositioning | A high-growth coastal market less saturated than Miami, offering high efficacy for Value-Add strategies and repositioning opportunities. |

| 6 | Charlotte, North Carolina | Multifamily Core, Single-Family Rentals (SFR) | A stable financial hub attracting corporate migration, supported by a pro-business market and moderate taxes. |

| 7 | Atlanta, Georgia | Logistics, Suburban Value-Add | Features a diversified economy that provides a favorable balance of risk and return, particularly in logistics and emerging suburban submarkets. |

| 8 | Nashville, Tennessee | Multifamily Premium, Regulated STRs | An attractive market driven by tourism and youth migration, with strong demand for Class A multifamily and clear rules for short-term rentals. |

| 9 | Orlando, Florida | Build-to-Rent, Touristic Multifamily | A massive tourism market with growing demand for BTR communities and Value-Add opportunities in multifamily assets near major employment clusters. |

| 10 | Houston, Texas | Multifamily Class B, Logistics Assets | A highly liquid market with accessible pricing, where Value-Add is viable, though it carries some commodity and climate-related risks. |

These top-ranked markets share several key attractive features that stand in direct contrast to the environment in New York:

- Regulatory Stability: These cities are predominantly located in states like Texas, Florida, and the Carolinas, which are known for their predictable, pro-business legal frameworks that protect property rights and encourage investment.

- Fiscal Advantages: The absence of state income tax in states like Florida and Texas provides a significant financial advantage, enhancing net returns for both investors and residents, which in turn fuels demand.

- Demographic Trends: The markets listed are at the center of strong domestic migration patterns, with robust population and job growth in the Sun Belt driving sustained demand for all forms of housing.

This strategic reallocation reflects a decisive pivot by institutional capital toward jurisdictions where the rules are clear, the growth is real, and the political climate is a tailwind, not a headwind.

9.0 Scenarios for New York: 2025–2035

The future of New York City’s real estate market and its viability for institutional investment hinge on the policy path its leadership chooses to follow. The proposed rent freeze represents a significant fork in the road. The following scenarios outline the range of potential outcomes based on the policy decisions made in the coming years.

Real estate strategies for family offices investing in Miami

9.1 Scenario 1: Implementation of a Rent Freeze

Should the city’s leadership proceed with a multi-year rent freeze, the projected financial outcomes are catastrophic, risking a systemic crisis that would extend beyond the real estate sector.

- Total Asset Value Destruction: Under a four-year rent freeze, financial projections show that a building’s Net Operating Income (NOI) could turn negative within 16 to 17 years. This trajectory points toward the complete erosion of asset value over the medium term, rendering a significant portion of the city’s housing stock financially unviable.

- Credit Delinquency Crisis: The delinquency rate for regulated multifamily loans, which already peaked at 16.43% in 2025, would likely surge far higher. This would trigger a wave of defaults, placing immense pressure on the regional banking system and potentially leading to bank failures.

- Massive Public Acquisition of Distressed Assets: Widespread owner insolvency would lead to mass tax foreclosures. This scenario could force the City of New York to acquire up to 100,000 distressed housing units, a bailout that would consume enormous fiscal resources and divert public funds from other essential services, including the construction of new affordable housing.

9.2 Scenario 2: Pivot to Structural and Supply-Side Reform

Alternatively, if the city’s leadership pivots away from price controls and instead focuses on addressing the root cause of the housing crisis—a chronic lack of supply—the long-term outcomes for affordability and market stability are significantly more positive.

- Supply Expansion Through Upzoning: A key supply-side reform would be to allow for denser housing development, particularly near public transit. It is estimated that upzoning land within a quarter-mile of subway stations could increase the city’s housing supply by 15% and, as a result, reduce city-wide rents by approximately 10%.

- Sustainable Infrastructure Financing via Value Capture: To support the new housing created by upzoning, the city could implement a value capture mechanism. This involves taxing a portion of the increase in private land value created by public infrastructure projects (like a new subway line) to sustainably finance those projects. This creates a virtuous cycle of transit expansion and housing development.

This second scenario offers a path toward genuine, long-term affordability without triggering the financial collapse and housing stock deterioration inherent in the rent freeze model.

10.0 Final Conclusions and Strategic Recommendations

The proposed rent freeze in New York City represents a critical inflection point for institutional real estate investors. It is not an isolated policy debate but the culmination of an increasingly hostile regulatory environment that fundamentally threatens the principles of property valuation and predictable returns. This analysis concludes that the measure, if implemented, would accelerate the flight of institutional capital from markets characterized by high regulatory risk to those offering stability, growth, and a partnership with private capital to solve housing challenges.

The structural risks for institutional investors in New York’s regulated multifamily sector are now undeniable and severe. The key findings of this report can be synthesized as follows:

- De-linking of Asset Value from Economic Fundamentals: A rent freeze breaks the essential connection between a property’s economic performance and its market value. By imposing a political ceiling on revenue while operating costs rise, the policy guarantees the erosion of Net Operating Income and, consequently, the destruction of asset value.

- Systemic Risk to the Regional Banking Sector: With delinquency rates on regulated multifamily loans already peaking at over 16%, a rent freeze would trigger a wave of defaults, posing a systemic threat to the regional banks that form the backbone of New York’s real estate credit market.

- Unviability of Proven Investment Strategies: Core institutional investment strategies, particularly Value-Add models that rely on improving assets to drive NOI growth, are rendered impossible. This not only eliminates a path to profitability but also ensures the long-term physical deterioration of the city’s housing stock.

Based on this comprehensive analysis, the following strategic recommendations are advised for institutional investors:

- Systematically Re-weight Portfolios Away from New York: Actively reduce exposure to New York City’s regulated multifamily market. Capital should be strategically reallocated to high-growth Sun Belt markets such as Miami, Dallas, and Austin, where demographic tailwinds and pro-business policies support sustainable returns.

- Prioritize Markets with Regulatory Certainty and Pro-Development Policies: Future capital deployment should be concentrated in jurisdictions that offer clear, stable, and predictable regulatory frameworks. This is essential to ensure the long-term viability of investment models like Build-to-Rent (BTR) and Value-Add, which require a cooperative policy environment to succeed.

- Incorporate Regulatory Beta as a Core Due Diligence Metric: Investors must elevate the assessment of political and regulatory risk (Regulatory Beta) to a primary consideration in all investment decisions, on par with traditional market and economic fundamentals. The «effect Zohran» demonstrates that headline risk can have an immediate and material impact on asset prices.

Ultimately, under the shadow of the proposed rent freeze and the broader regulatory trajectory it represents, New York City can no longer be considered a stable or predictable market for institutional real estate investment. The combination of value destruction, credit risk, and political uncertainty has created an environment where the prudent and necessary course of action is strategic capital reallocation to more favorable jurisdictions.

For family offices and institutional LPs, these findings align with the underlying logic of our Institutional Track Record, which demonstrates how disciplined reallocation away from punitive jurisdictions preserves both EM and IRR across cycles.

11.0 Annexes

A. Comparative Data on nyc rent freeze program Impacts

The following table summarizes key quantitative outcomes of stringent rent control policies across three major international cities, based on data presented in the source material.

| Metric | New York City | Berlin | San Francisco |

| Asset Valuation Decline | ~30% (Post-2019 HSTPA) | Not Specified | Not Specified |

| Credit Delinquency Rate | 16.43% (Peak in regulated multifamily loans, 2025) | Not Specified | Not Specified |

| Rental Supply Reduction | Not Specified (but documented warehousing of 60,000+ units) | >50% (Reduction in advertised units) | 15% (Reduction in total rental stock) |

| Landlord Investment Intent | Severely curtailed by HSTPA’s MCI/IAI limits | Nearly 60% of landlords reduced willingness to invest | Not Specified |

| City-Wide Rent Impact | Not Specified | Not Specified | +5.1% (Spillover effect) |

| Property Conversion Rate | Not Specified | Not Specified | Regulated buildings 10% more likely to convert to condos |

B. Key Technical Definitions

- Net Operating Income (NOI): The income generated by a revenue-producing property after accounting for all operating expenses but before servicing debt or paying income taxes. It is a primary metric for determining an asset’s value.

- Regulatory Beta: A measure of an asset’s price volatility in response to changes or uncertainty in the political and regulatory environment. A high Regulatory Beta indicates that an asset’s value is highly sensitive to political risk.

- Value-Add Investing: A real estate investment strategy that involves acquiring an underperforming property, making capital improvements to increase its NOI, and thereby forcing its appreciation in value.

- Housing Misallocation: An economic inefficiency caused by rent control where tenants remain in units that no longer suit their needs (e.g., too large or too small) because of the financial benefit of below-market rent. This reduces overall market liquidity and housing availability.

- Spillover Effect: The phenomenon where policies imposed on one segment of a market (e.g., rent-controlled units) cause unintended consequences in another segment (e.g., rent increases in non-controlled units) due to shifts in supply and demand.

C. Regulatory Chronology

- 2019: The Housing Stability & Tenant Protection Act (HSTPA) is passed in New York, severely curtailing landlords’ ability to increase rents after vacancies or capital improvements.

- Post-2019: A documented drop of approximately 30% in the valuation of regulated multifamily assets in New York City is observed following the passage of the HSTPA.

- ~2024/2025: Political figure Zohran Mamdani champions a proposal for a four-year rent freeze on all rent-stabilized apartments in New York City.

- 2025: The credit delinquency rate for loans on regulated multifamily properties in New York City is projected to reach its peak of 16.43%.

New York Rent Freeze: Institutional Risk & Sunbelt Migration

Institutional answers to critical questions about the impact of the proposed New York rent freeze on asset valuation, regulatory risk, and strategic capital reallocation to stable markets.

Editorial & Professional Conclusion

After analyzing the data, the regulatory trajectory, and the structural vulnerabilities emerging in New York’s multifamily market, my professional conclusion is unequivocal: the proposed rent freeze is not merely a housing policy—it is a systemic risk event. From my perspective as an institutional analyst, what is unfolding in New York is a textbook example of how political intervention can sever the link between economic fundamentals and asset value, creating an environment where even the most conservative investment models cannot function.

I have worked across multiple U.S. real estate markets, and nowhere else have I observed such a stark divergence between political intent and financial reality. A multi-year rent freeze would not simply “protect tenants”; it would accelerate the financial insolvency of hundreds of thousands of units, destabilize regional banks, and force the city into an unsustainable public acquisition of distressed housing. In parallel, it would permanently destroy the viability of Value-Add strategies—the backbone of institutional multifamily investment—and eliminate the incentive to maintain or reinvest in existing stock.

From an investor’s standpoint, the contrast with pro-development markets could not be clearer. Cities like Miami, Dallas, and Phoenix demonstrate that when policy aligns with economic logic—predictable regulation, supply expansion, and fiscal incentives—capital flows, housing improves, and affordability increases organically. New York is choosing the opposite path, and capital is responding accordingly.

In my assessment, the strategic imperative for institutional investors is no longer optional but urgent: reduce exposure to New York’s regulated multifamily sector and reallocate toward jurisdictions where economic fundamentals, demographic growth, and regulatory clarity form a stable foundation for long-term value creation. The Prime Residential Value-Add model, in particular, remains fully viable and exceptionally profitable in these alternative markets.

Ultimately, my position is simple: cities that collaborate with private capital will solve their housing challenges; cities that fight it will deepen them. New York stands at a crossroads, and unless its policymakers pivot toward structural reform, it risks losing not only investor confidence but its competitive edge in the national real estate landscape.

The key findings of this analysis are as follows:

Systemic Credit Risk is Acute and Quantifiable: The delinquency rate for loans on regulated multifamily properties in New York City is projected to peak at 16.43% in 2025, a stark contrast to the sub-1% rate for non-regulated assets. This signals a severe and concentrated credit crisis for exposed regional banks.

Significant Asset Devaluation is Already a Reality: New York’s 2019 Housing Stability & Tenant Protection Act (HSTPA) has already caused an approximate 30% decline in the valuation of regulated multifamily assets. A rent freeze would accelerate this destruction of value, rendering traditional Discounted Cash Flow (DCF) models invalid.

A Rent Freeze Projects Total Asset Value Destruction: Financial modeling indicates that under a four-year rent freeze, a regulated building’s Net Operating Income (NOI) could turn negative within 16 to 17 years, effectively erasing the asset’s long-term value.

International Evidence Confirms Negative Supply-Side Effects: The proposed freeze mirrors policies in other cities with consistently negative outcomes. Berlin’s rent freeze led to a reduction of over 50% in advertised rental supply, while San Francisco’s rent control expansion reduced its rental housing stock by 15%.

Deregulation Demonstrates High Supply Elasticity: The repeal of a restrictive rental law in Buenos Aires led to a 170% increase in rental availability and a 40% drop in real prices, demonstrating that capital and supply respond swiftly and positively to regulatory relief.

Value-Add Investment Models are Inviable in NYC: The core institutional strategy of Value-Add investing—increasing NOI through capital improvements—is rendered impossible by the HSTPA’s severe restrictions on recovering capital expenditures (MCIs/IAIs).

Capital is Strategically Migrating to Pro-Development Markets: Institutional investors, REITs, and family offices are actively reallocating capital to Sun Belt cities like Miami, Dallas, and Austin. These markets are prioritized for their regulatory stability, pro-landlord laws, and absence of political ceilings on rent growth.

Regulatory Beta is Now a Primary Diligence Metric: The «effect Zohran»—the immediate drop in NYC-exposed REIT stock prices following the rent freeze proposal—has solidified «Regulatory Beta» as a critical risk factor that now outweighs traditional market fundamentals for many investors.

Supply-Side Reforms Offer a Viable Alternative Path: Analysis shows that upzoning land near transit hubs in NYC could increase housing supply by 15% and reduce city-wide rents by 10%, presenting a structural solution to the affordability crisis without destroying asset value.

Fiscal Insolvency Poses a Risk to the City Itself: An estimated 10% of NYC’s rent-stabilized stock (up to 100,000 units) is already operating near financial insolvency. A rent freeze could trigger mass tax foreclosures, potentially forcing the city to acquire these properties at an enormous fiscal cost.

Complete References ARCSA

List:

- https://cayimby.org/blog/a-comprehensive-study-of-rent-control/

- https://www.vitalcitynyc.org/articles/a-housing-roadmap-for-new-yorks-next-mayor

- https://d-nb.info/1227931301/34

- https://www.iwkoeln.de/en/studies/pekka-sagner-michael-voigtlaender-how-the-berlin-rent-cap-affected-private-landlords-517575.html

- https://www.mossadams.com/articles/2020/09/impact-of-rent-control-laws

- https://www.trepp.com/trepptalk/rent-regulation-impact-analysis-breaking-down-regulated-multifamily-markets

- https://www.credaily.com/briefs/how-exposed-are-ny-banks-to-rent-stabilized-loans/

- https://docs.iza.org/dp18107.pdf

- https://business.columbia.edu/milstein-center-research-lab/mamdani-rent-freeze-new-york-city

- https://rentboard.berkeleyca.gov/sites/default/files/2022-01/Other_2018_Jan_N.B.E.R._The%20Effects%20of%20Rent%20Control%20Expansion…_R.%20Diamond%20et%20al..pdf