Las commodities representan una herramienta estratégica para diversificar portafolios y proteger capital frente a la volatilidad del mercado. Desde energía y metales hasta bienes agrícolas, estos activos ofrecen exposición a la economía real y pueden funcionar como cobertura ante inflación e incertidumbre financiera.

En este artículo se explican sus usos principales—cobertura de riesgos, especulación y gestión de exposición—y se resumen los tipos más comunes (opciones, futuros, swaps y CFD) con ejemplos de para qué se utilizan.

Bajo la gestión activa de ARCSA CAPITAL, este modelo se especializa en el mercado inmobiliario de Florida, transformando capital en patrimonio productivo mediante la optimización del NOI y estrategias de Forced Appreciation.

Querer Invertir en un inmueble para obtener ingresos por renta puede ser una excelente manera de generar ingresos pasivos y aumentar su patrimonio. Sin embargo, es importante ser consciente de todos losriesgos y desafíos que puede enfrentar antes de tomar una decisión. Problemas comunes: Desafíos adicionales: Consejos para mitigar los riesgos: Problemas financieros: Problemas de...

This guide explores the transition from delegated management to direct investment, featuring ARCSA’s 120-day vertical execution cycle, 1.25x DSCR risk mitigation, and the 21% Target IRR thesis designed for the 2026 fiscal landscape.

The American real estate landscape in January 2026 is defined by a paradox: restricted institutional competition and stabilized, yet elevated, financing costs. Following President Trump’s executive order, «Stopping Wall Street from Competing with Main Street Homebuyers,» the market for single-family rentals (SFR) has undergone a structural reset. For sophisticated investors, the most lucrative real estate...

Optimice su Asset Protection en Florida mediante nuestra arquitectura de Preferred Equity diseñada para UHNW Family Offices.

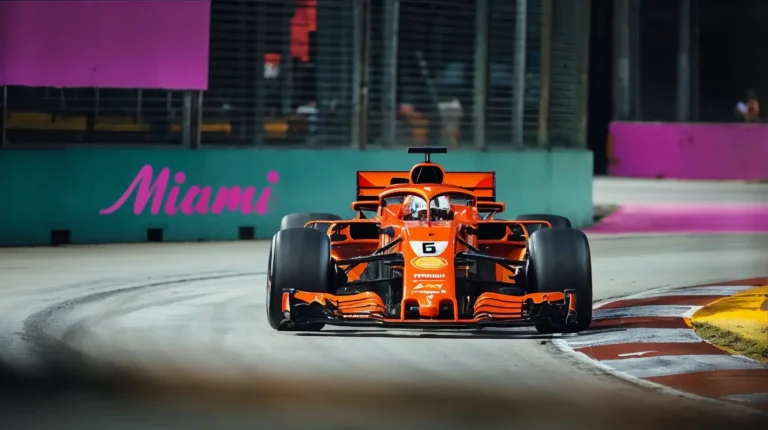

Experience the thrill and luxury of the F1 Miami Grand Prix 2026. Discover how speed, spectacle, and elite lifestyle converge at the Hard Rock Stadium for one of the most electrifying and sophisticated weekends on the global calendar.

In a city where luxury is not an accessory but a way of life, Miami is preparing to host one of the most anticipated sporting events of the decade: the Miami Championship 2026, officially sanctioned by the PGA Tour. From April 29 to May 3, 2026, the global elite of golf will converge at the...

How audited, GC-led operations—backed by robust controls, live KRIs, and cross-border fund structures—turn high-variance fix-and-flip into a turnkey, institutional strategy that mitigates operational risk and earns UHNW investor trust.