Real estate investing in dubai has long been the gold standard for global capital seeking tax-efficient growth and world-class infrastructure. However, in the current cycle of January 2026, sophisticated investors in the UAE are identifying a new frontier for high-alpha returns. While the Dubai market remains a bastion of stability, the structural shifts in the...

The American real estate landscape in January 2026 is defined by a paradox: restricted institutional competition and stabilized, yet elevated, financing costs. Following President Trump’s executive order, «Stopping Wall Street from Competing with Main Street Homebuyers,» the market for single-family rentals (SFR) has undergone a structural reset. For sophisticated investors, the most lucrative real estate...

A 2026 institutional guide to Miami real estate private equity, focused on disciplined capital structures, GP/LP alignment, and operationally driven returns. Designed for family offices and institutional investors seeking predictable performance, downside protection, and high-conviction strategies in Miami’s most resilient submarkets.

Optimice su Asset Protection en Florida mediante nuestra arquitectura de Preferred Equity diseñada para UHNW Family Offices.

Trump’s January 20, 2026 executive order to curb institutional SFR purchases reshapes the U.S. housing landscape, but it opens a rare window for Miami‑based boutique funds.

When I think about Miami luxury real estate, I see more than iconic architecture and prime waterfront views—I see a market powered by global capital, long-term demand, and strategic resilience. Over the years, Miami has matured into a true international gateway where high-net-worth buyers, family offices, and institutions value not just lifestyle but also liquidity,...

Real estate remains one of the most reliable paths to long-term financial freedom. This article explores how strategic property investing—through diversification, passive income, appreciation, and tax advantages—can help secure a stable and predictable retirement, even as traditional financial vehicles lose strength.

Discover how foreign investors can unlock strategic opportunities in global real estate markets. This concise guide breaks down key regulations, market insights, and practical steps to invest confidently abroad while maximizing long-term value.

This institutional briefing examines how New York’s proposed multi-year rent freeze threatens asset values, accelerates banking risk, and drives capital reallocation toward pro-development Sunbelt markets like Miami, Dallas and Austin. Includes international evidence, financial modeling and strategic recommendations.

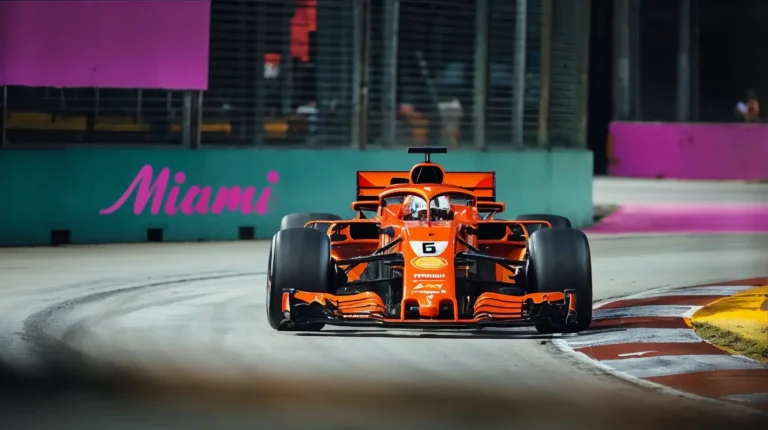

Experience the thrill and luxury of the F1 Miami Grand Prix 2026. Discover how speed, spectacle, and elite lifestyle converge at the Hard Rock Stadium for one of the most electrifying and sophisticated weekends on the global calendar.